An Intro to Conversational AI in Banking

Conversational AI has revolutionized the banking and financial services industry in recent years. That’s where machine learning algorithms come in – enabling humans and machines to have natural language conversations. That capability has the power to transform how banks interact with their customers and provide services that are both personalized and convenient.

The driving force behind the rise of conversational AI technology has been the demand for services that are tailored to the individual and delivered efficiently. As AI technology has gotten smarter, so too has the demand for those services. And that’s exactly what’s happening. Financial services providers and banks are increasingly turning to conversational AI solutions to meet that demand for personalized, convenient services.

The Rise of Conversational AI in Banking Sector

Personalized and convenient banking services are what customers are increasingly demanding and getting. That’s because 88% of banking executives believe that conversational AI will soon be the go-to channel for customer interactions.

Key Drivers Behind the Surge of Conversational AI in Banking

One of them is customers’ desire to bank on the go. They want to access services using their mobile devices or smart speakers. That’s where conversational AI comes in: providing a seamless way to get those services without the hassle of phone calls or in-person visits.

Advances in natural language processing and machine learning have made conversational AI a lot more effective. Voice recognition technology, conversational IVR, and AI Voice bots have gotten much better at understanding and answering complex questions. And that’s exactly what customers want.

The pandemic has also accelerated the adoption of conversational AI in banking. With social distancing in place, customers are naturally turning to digital banking channels. And conversational AI is the perfect way to meet that need,for customers to access banking services without having to physically interact.

Benefits of Conversational AI in Banking

Conversational AI, where technology meets customer service, brings a wealth of benefits to both banking customers and financial institutions. Customers love the convenience it offers: no more phone calls or in-person visits to perform tasks like checking your account balance, making payments, or managing your finances. You can do all that and more using simple voice commands or chatbots.

That convenience translates to banks, too. With conversational AI, they get to know their customers better, reduce operational costs, and run more efficiently. By automating routine customer interactions, banks can free up staff to tackle the tough stuff: resolving customer complaints, providing financial advice, and helping customers achieve their goals.

Conversational AI also gives banks a treasure trove of data on customer behavior and preferences. That data reveals new revenue opportunities and ways to improve services. By analyzing customer data with machine learning algorithms, banks can develop a deep understanding of customer journeys and use that insight to improve their existing products and services.

Customer-Centric Use Cases of Conversational AI in Finance

Conversational AI has changed the way banks talk to their customers. With the power of artificial intelligence, banks can now offer personalized recommendations, advice, and transactions. Here are some customer-centric use cases of conversational AI in financial services and banking:

1. Personalized Advice

Help customers with financial planning by generating personalized advice based on their financial behavior and goals. Banks can use conversational AI to recommend investments and retirement plans based on a customer’s risk tolerance and investment preferences. Customers can also get updates on their investment performance via their preferred channels, like proactive messaging via SMS or email.

2. Transactional Support

Offer a range of transactional activities like checking account balances, transferring funds, and paying bills. These chatbots can also send real-time alerts, like when a payment is due or when a credit limit has been exceeded. So customers don’t miss important deadlines and stay on top of their finances.

3. Product Recommendations

Recommend products to customers based on their financial behavior and purchasing patterns. For example, a customer who uses their credit card for online purchases may get recommendations for credit cards that offer rewards and cashback on online purchases.

Similarly, a customer who transfers funds to their family members may get recommendations for a checking account that offers free intra-bank transfers.

4. Customer Support

Conversational AI can also support customers with their queries and complaints, 24/7. AI customer service can handle a range of customer queries well, like questions about account balances, transaction history, and interest rates. These chatbots can also escalate queries to human agents when needed, so customers get prompt and accurate responses.

By customizing conversational AI solutions for the banks, these use cases can be adapted to offer a super personalized experience to customers.

Aisera’s Conversational AI Solution For Banking

A conversational AI platform is a potent tool for banks. These platforms allow institutions to roll out AI-driven virtual and AI Voice Bot. They seamlessly integrate across various channels, including websites, messaging apps, and mobile platforms.

At their core, these platforms utilize advanced natural language processing. This enables them to accurately interpret customer inquiries. Coupled with sentiment analysis, they’re equipped to gauge satisfaction levels in real-time.

The power of machine learning shouldn’t be underestimated. As these platforms leverage it, they continually adapt to changing customer behaviors. This adaptability results in banks being able to offer more personalized services. The outcome? Enhanced customer experiences and increased brand loyalty.

One of the significant advantages for banks is automation. By automating routine customer interactions, there’s a dual benefit: heightened efficiency and marked cost savings. It shifts the focus, allowing banks to allocate resources to complex tasks that demand human expertise.

To sum it up, conversational AI platforms aren’t just beneficial — they’re essential. Banks looking to truly elevate customer support and craft superior experiences will find them indispensable.

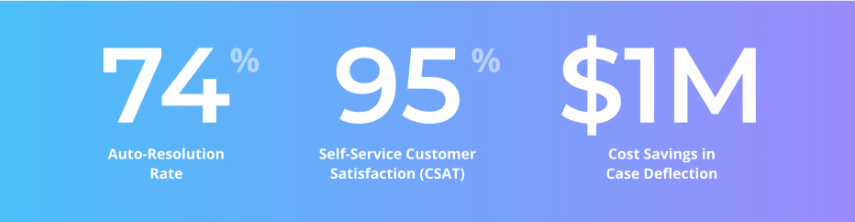

In the image below, you see how Aisera’s AI and Automation: Boosting Customer Service Metrics in Financial Services

Banking on AI: Lessons from Industry Leaders

As conversational AI becomes increasingly popular in the banking industry, many institutions are looking toward the early adopters of this technology to learn from their success stories. Some of the best examples of the conversational banking experience are provided by Wells Fargo, Bank of America, and Capital One.

Wells Fargo was one of the first banks to launch a virtual assistant named Fargo that uses natural language processing to help customers with a range of tasks such as checking account balances, paying bills, and tracking expenses. Fargo is available through SMS, which enhances the accessibility of the chatbot.

| Bank of America | Capital One |

| Bank of America launched Erica, an AI-powered digital assistant that can perform a range of tasks such as account management, bill payment, and fraud detection. Erica’s strength lies in its personalized recommendations, which are based on the customer’s spending habits and financial goals. | Capital One has invested heavily in conversational AI, with its virtual assistant Eno being one of the most feature-rich chatbots in the industry. Along with the standard features such as balance checking and transaction tracking, Eno can also provide virtual card numbers for online purchases. |

These banks have demonstrated that success in conversational banking requires a comprehensive understanding of customer feedback, needs, and preferences, along with a willingness to innovate and experiment with new technologies.

Leveraging conversational Artificial Intelligence in financial services is not limited only to American Banks. Similarly, Indian Banks are using Conversational AI chatbot technology as AI-powered virtual assistants.

For instance, Kotak Mahindra Bank in India has created its virtual assistant named KEYA. Keya is a smart bank assistant that helps customers with credit and debit card inquiries, loan applications, and answering questions.

Other banks seeking to implement conversational AI solutions should look towards these early adopters as valuable sources of inspiration and guidance.

The Future of AI in Finance

Taking Banking and AI Steps Further

The rise of conversational AI in banking is set to continue, with more banks expected to adopt these technologies in the coming years. The use of banking chatbots and voice assistants is expected to become increasingly prevalent, providing customers with a more personalized and convenient banking experience.

The continued leveraging of conversational AI for banking is expected to bring significant benefits to both customers and banks, transforming the way banking services are offered and delivered.

Generative AI in Banking

While conversational AI has already made its mark, another transformative technology, generative AI, is paving the way for even more advanced interactions in the banking sector. By combining deep learning algorithms with natural language processing (NLP), Generative AI empowers AI virtual assistants to understand and respond to customer inquiries in a more personalized and dynamic way.

Generative AI in Banking can be harnessed for various applications. One key use is generating personalized product recommendations derived from a customer’s financial history and preferences. For instance, if a customer frequently allocates funds towards travel and dining, Generative AI in Banking can propose relevant credit card offers and loyalty programs that resonate with these spending habits.

In recent years, AI and automation in banking have made a big difference in the banking and financial sectors. As customers ask for more personalized and faster services, banks are using more AI and automation. This shift reflects the broader impact of AI in fintech, where advanced technologies are streamlining operations and improving customer satisfaction across the industry.

AI Copilots for Finance

Copilots for finance have changed the industry by being intelligent assistants that boost productivity, accuracy, and decision-making. They can automate financial tasks such as data reconciliation, reporting, and forecasting, so finance professionals can focus on strategic analysis and risk management.

Integrated with enterprise systems, AI copilots provide real-time insights, flag anomalies, and support compliance. For finance controllers they are force multipliers – breaking down data silos, increasing visibility and driving agility in financial planning and operations.

AI Agents for Banking

AI agents are redefining customer engagement and operational workflows in banking. These autonomous systems can handle complex service requests, fraud detection, and transaction monitoring with minimal human intervention.

Unlike traditional chatbots, AI agents have advanced contextual understanding and memory so they can manage multi-turn conversations and complete end-to-end tasks such as loan processing or account setup. They can adapt, learn from past interactions, and integrate with core banking systems, making them a strategic asset in delivering seamless, hyper-personalised customer experiences while optimising operational efficiency.

Conclusion

Conversational AI has emerged as a game-changer in the banking and financial services industry, offering new and innovative ways to improve customer experience while boosting operational efficiency. As we have seen, conversational AI is rapidly gaining popularity in the banking sector, driven by factors such as increasing customer demand for personalized and convenient services and the need for cost savings and improved efficiency.

As machine learning continues to advance, the role of virtual assistants and voice assistants will become even more critical in delivering exceptional customer experiences. To stay competitive and provide the best possible service, banks must embrace AI and other innovative technologies fully. Book a free AI demo today!