Generative AI for

Financial Services and Banking

business value and elevate your customer experience at scale.

Trusted by leading companies in Banking and Financial Services

Virtual Assistants are transforming the Banking and Financial Services Industry

75%

Auto-Resolution

Rate

50%

Improved Agent

Productivity

60%

First Call Resolution

Improvement

Use Cases

![]()

Account setup and

management

Assist customers with authentication, account setup and registration. Aisera’s Conversational AI can provide relevant account information, send notifications when the balance falls below a specified limit, open new credit lines and more.

![]()

Track payments and

deposits

Proactively notify customers of upcoming payment due dates. It enables customers to make deposits in a seamless and frictionless manner by accessing their account information securely to verify transactions and process payments.

![]()

Dispute transactions

Make it easy for customers to dispute financial transactions across multiple digital channels. Our intelligent virtual assistant simplifies and streamlines the process by reducing the time for customer discussions to help strengthen the relationship.

![]()

Replace stolen or

lost cards

Monitor transaction history and quickly report any suspicious fraudulent activity within an account. The digital assistant automates the process to report lost cards and apply for a new one.

![]()

Seamless bot to

agent hand-off

Bots can analyze natural language and utterance to interpret when a customer is frustrated or unhappy. It uses sentiment analysis to seamlessly transition the conversation to a live agent.

![]()

View Transaction History

Automate simple tasks, which would otherwise require agent assistance such as verifying identity, status of an outgoing payment transfer or providing the working hours of the nearest branch.

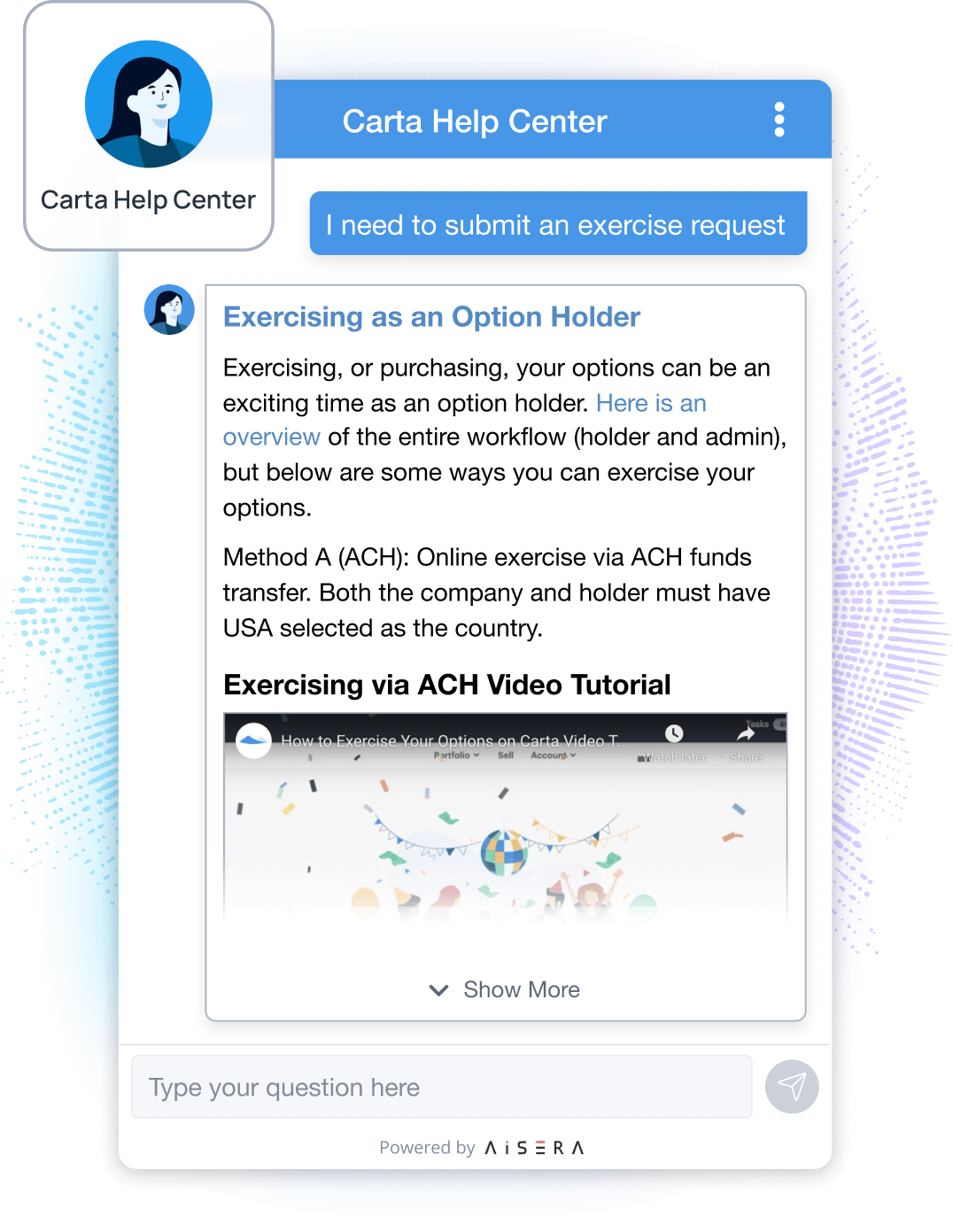

Learn how Carta Saved Over $1M with Self-Service Automation at Scale

Benefits

Up to 75% Auto-Resolution Rate with Conversational AI & Automation

Achieve over 85% CSAT with built-in analytics & finance-specific ontology

Save over $1M in customer service and support costs

Integrations