Introduction to the Role of Generative AI in Insurance

With Generative AI making a significant impact globally, businesses need to explore its applications across different industries. The insurance sector, in particular, stands out as a prime beneficiary of artificial intelligence (AI) technology. In this article, we delve into the reasons behind this synergy and explain how Generative AI can be effectively utilized in insurance.

This article delves into the synergy between Generative AI and insurance, explaining how it can be effectively utilized to transform the industry. You will explore use cases of Generative AI in insurance with examples.

Understanding the Role of AI in Insurance

Generative AI, a subset of artificial intelligence, primarily utilizes Large Language Models (LLMs), Natural Language Processing (NLP), and machine learning (ML) techniques. Although the foundations of AI were laid in the 1950s, modern Generative AI has evolved significantly from those early days. Machine learning, itself a subfield of AI, involves computers analyzing vast amounts of data to extract insights and make predictions.

What sets Generative AI apart? Generative AI systems are developed based on prompts and extensive pre-training on large datasets. The output can take various forms, including text, audio, images, and video. Think of it as autocomplete but significantly more powerful. Essentially, Generative AI generates responses to prompts by identifying patterns in existing data across various domains, using domain-specific LLMs.

This adaptability is crucial because it allows Generative AI to better understand patterns in language, images, and video, which it leverages to produce accurate and contextually relevant responses.

After exploring the capabilities of Generative AI and understanding how an enterprise LLM can be fine-tuned for a specific industry to deliver more efficient and accurate responses, let’s examine how Generative AI can be applied in the insurance industry.

Generative AI Use Cases in Insurance

Generative AI is rapidly transforming the US insurance industry by offering a multitude of applications that enhance efficiency, operations, and customer experience.

However, its impact is not limited to the USA alone; other countries, such as Canada and India, are also equipping their companies with AI technology. For instance, Niva Bupa, one of the largest stand-alone health insurance companies in India, has invested heavily in AI. More than 50% of their policies are now issued with zero human intervention, entirely digitally, and about 90% of renewals are also processed digitally.

In this overview, we highlight key use cases, from refining risk assessments to extracting critical business insights. As insurance firms navigate this tech-driven landscape, understanding and integrating Generative AI becomes imperative. Dive in to discover its transformative potential in the sector.

1. Improve Risk Assessment

To determine how likely it is a prospective customer will file a claim, insurance companies run risk assessments on them. By understanding someone’s potential risk profile, insurance companies can make more informed decisions about whether to offer someone coverage and at what price.

Generative AI can improve the risk assessment process in a few ways. For one, it can be trained on demographic data to better predict and assess potential risks. For example, there may be public health datasets that show what percentage of people need medical treatment at different ages and for different genders. Generative AI trained on this information could help insurance companies know whether or not to cover somebody.

The technology could also be used to create simulations of various scenarios and identify potential claims before they occur. This could allow companies to take proactive steps to deter and mitigate negative outcomes for insured people.

Another way Generative AI could help with risk assessment is by aiding coders in creating statistical models. Programmers can use Gen. AI to review or detect bugs in code. This ability can speed up the programming work, requiring companies to hire fewer software programmers overall.

In the long run, the improvements to risk management offered by Generative artificial intelligence solutions can save insurance businesses a lot of time and money.

2. Enhance Underwriting

Generative AI can also enhance the underwriting process. Typically, underwriters must comb through massive amounts of paperwork to iron out policy terms and make an informed decision about whether to underwrite an insurance policy at all.

For example, Generative AI in banking can be trained on customer applications and risk profiles and then use that information to generate personalized insurance policies. Furthermore, by training Generative AI on historical documents and identifying patterns and trends, you can have it tailor pricing and coverage recommendations.

As a result, the underwriting process will be much more thorough, and overall claims costs will be lower. Plus, underwriters will be able to work more efficiently by processing applications faster and with fewer errors, which, in turn, can lead to higher customer satisfaction ratings.

3. Streamline Claims Processing

Generative AI offers significant advantages in streamlining insurance claims processing, aiding in claims prevention, and automating routine tasks such as data entry and analysis. Here’s how Generative AI enhances efficiency across different types of claims:

Car Insurance Claims:

- Automated Data Entry: Generative AI can automatically input data from accident reports and repair estimates, reducing errors and saving time.

- Priority Organization: Claims can be sorted by severity and urgency, ensuring that critical cases are addressed promptly.

Real Estate Property Claims:

- Document Summarization: Generative AI tools can quickly summarize lengthy property damage reports and legal documents, allowing adjusters to focus on decision-making rather than paperwork.

- Analysis Enhancement: AI can analyze historical weather data and property records to identify patterns that might indicate fraudulent claims.

General Insurance Claims:

- Enhanced Data Analysis: For broader insurance categories, Generative AI can process vast amounts of claims data, identifying trends and outliers that help predict future claims and prevent fraud.

- Priority and Complexity Sorting: AI can organize claims based on their complexity and the resources required to resolve them, optimizing workflow efficiency.

While automation through Generative AI significantly reduces the time and cost associated with processing claims, the need for human touchpoints remains essential. Human oversight ensures that the nuances of complex cases are handled with care. However, by integrating Generative AI into certain facets of the claims process, insurance companies can cut operational costs and enhance the overall customer experience. This blend of technology and human expertise not only speeds up processing but also improves accuracy and customer satisfaction.

4. Generative AI for Insurance Fraud Detection

Insurance fraud is a major industry in and of itself. According to the FBI, $40 billion is lost to insurance fraud each year, costing the average family $400 to $700 annually. Although it’s impossible to prevent all insurance fraud, insurance companies typically offset its cost by incorporating it into insurance premiums.

Generative AI offers promising ways to reduce insurance fraud. By analyzing patterns in claims data, Generative AI can detect anomalies or behaviors that deviate from the norm. If a claim does not align with expected patterns, Generative AI can flag it for further investigation by trained staff. This not only helps ensure the legitimacy of claims but also aids in maintaining the integrity of the claims process.

Benefits for Insurance Companies

By implementing Generative AI in their fraud prevention departments, insurance companies can significantly reduce the number of fraudulent claims paid out, boosting overall profitability. This, in turn, allows businesses to offer lower premiums to honest customers, creating a win-win situation for both insurers and insureds.

6. Extract Valuable Business Insights

Finally, insurance companies can use Generative Artificial Intelligence to extract valuable business insights and act on them.

For example, Generative Artificial Intelligence can collect, clean, organize, and analyze large data sets related to an insurance company’s internal productivity and sales metrics.

It could then summarize these findings in easy-to-understand reports and make recommendations on how to improve. Over time, quick feedback and implementation could lead to lower operational costs and higher profits.

At the end of the day, it’s impossible to list all of the potential use cases for Generative Artificial Intelligence & ChatGPT in the insurance industry since the technology is always evolving. That said, these are some of the most obvious ways to implement Generative AI power in the insurance business, and insurance companies that don’t start trying them will be left behind by companies that do.

7. Personalize Products and Services

Insurance companies can also use Generative AI for product offerings to serve existing customers with personalized products and services. For example, you can develop a Conversational AI platform powered by Generative AI to answer specific, customer inquiries and questions about policy coverage and terms.

Integrating Conversational AI in insurance industry brings numerous benefits, including the potential for cost savings by reducing the need for live customer support agents.

Similarly, you can train Generative AI on customers’ policy preferences and claims history to make personalized insurance product recommendations. This can help insurers speed up the process of matching customers with the right insurance product.

In addition, Generative AI can also revolutionize other aspects of insurance services by leveraging insurance copilots. For instance, it can automate the generation of policy and claim documents upon customer request. This automation eliminates the need for human staff to manually process these requests, significantly reducing wait times and improving efficiency. Customers receive the documents they need promptly, precisely when they need them.

In essence, the demand for customer service automation through Generative AI is increasing, as it offers substantial improvements in responsiveness and customer experience.

Challenges of Leveraging Generative AI in Insurance

It’s important to note that despite all the benefits of using Artificial Intelligence in insurance, like all technologies, it has its limitations. Here are a few of them:

Limited knowledge: Many AI tools are only trained on data up to a certain date (September 2021 in the case of ChatGPT). As a result, outputs may not reflect the most recent data and may be flawed as a result.

Potential bias: Because many Gen AI tools are trained on publicly available data, they may reflect bias in their outputs. For example, if trained on the internet, Generative AI may reflect the biases that exist on the internet.

Inaccuracies: Though Generative AI tries to be as accurate as possible, it can make mistakes, especially when it is forced to iterate too long on the same prompt. In the case of ChatGPT, too many questions may confuse it and cause it to “hallucinate.”

Unequipped for complex underwriting: Underwriting can get complex when it involves many human variables. AI may not be able to handle these since it operates mostly on hard data.

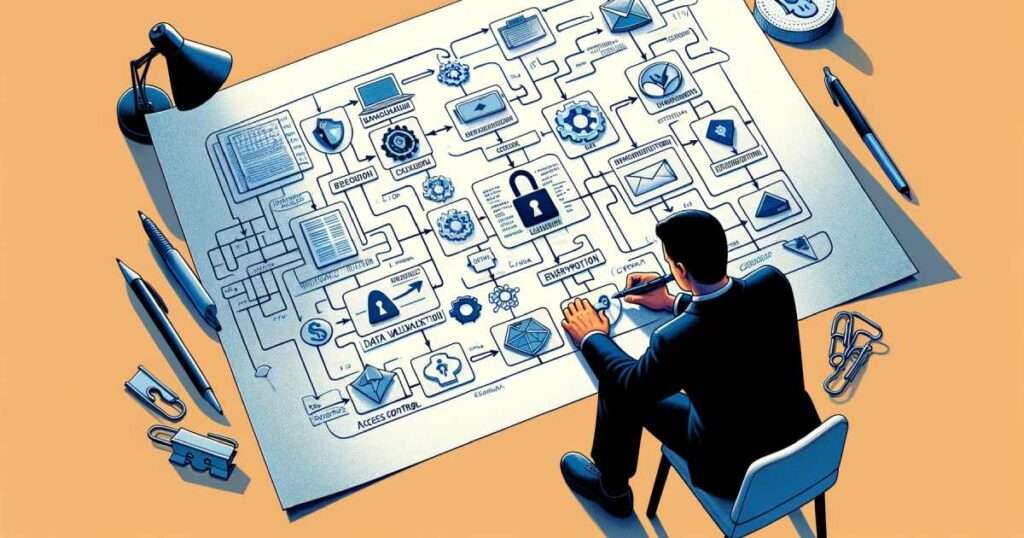

Ethical concerns: Data privacy is a major concern worldwide. As cybercrime continues to grow, Enterprise insurance businesses must be extra careful when letting Generative AI handle sensitive information. They must also be careful about using facial recognition apps, as not all consumers want their facial data stored.

Lack of empathy: By nature, Generative AI cannot show real empathy. This can become a problem when addressing customer concerns and acknowledging moral hazards.

Regulatory limits: As Generative AI evolves and becomes more widespread, governments will try to regulate it with new legislation. Keeping up with and complying with these regulations could prove costly for an insurance company.

Are Insurance Coverage Clients Prepared for Generative AI?

As the insurance industry begins to integrate Generative AI into its operations, a crucial question arises: Are clients ready to embrace this advanced technology?

Customer preparedness involves not only awareness of Generative AI’s capabilities but also trust in its ability to handle sensitive data and processes with accuracy and discretion. Surveys indicate mixed feelings; while some clients appreciate the increased efficiency and personalized services enabled by AI, others express concerns about privacy and the impersonal nature of automated interactions.

Therefore, insurance companies must invest in educational campaigns to inform their clients about the benefits and security measures of Generative AI. Equally important is the need to ensure that these AI systems are transparent and user-friendly, fostering a comfortable transition while maintaining security and compliance for all clients.

Start With Generative AI in the Insurance Industry

Now that you know the benefits and limitations of using Generative Artificial Intelligence in insurance, you may wonder how to get started with Generative AI.

The true potential of AI extends far beyond just cutting expenses. The holy grail for businesses, especially in the insurance sector, is the ability to drive top-line growth.

– Muddu Sudhakar, Co-founder, Aisera

If you’re an insurance company looking to leverage AI for insurance, you’ve come to the right place. Aisera’s Agentic AI platform is tailored to enterprises, including insurance companies. We offer products such as virtual assistants, personalized policy recommendations, claims automation, dynamic forms, workflow automation, streamlined onboarding, live AI agents and more.

We also have tools for enterprises in the following industries: Education, Federal, State, and local Government, Financial Services and Banking, Healthcare and Hospitals, Hi-Technology, Hospitality, Travel and Transportation, Insurance, Media and entertainment, Pharma and Biotech, Retail & eCommerce, and Telecom & Utilities.

Conclusion

Whatever industry you’re in, we have the tools you need to take your business to the next level. The human touch won’t ever go away. However, companies that use AI to automate time-consuming, mundane tasks will get ahead faster. So now is the time to explore how AI can have a positive effect on the future of your business.

Feel free to request a custom AI demo of one of our products today to learn more about them. We look forward to getting to know your business and matching it with the right Generative AI solution to help it grow.